Earned Income Credit 2024 For Single Person. Tax credits can come in handy when tax filing season rolls around. See the earned income and.

The dollar am out of credits ranges from $600. People should understand which credits and deductions they.

How Much Is The Eitc?

There are numerous qualification rules.

See The Earned Income And.

Us$200,000 for single or head of.

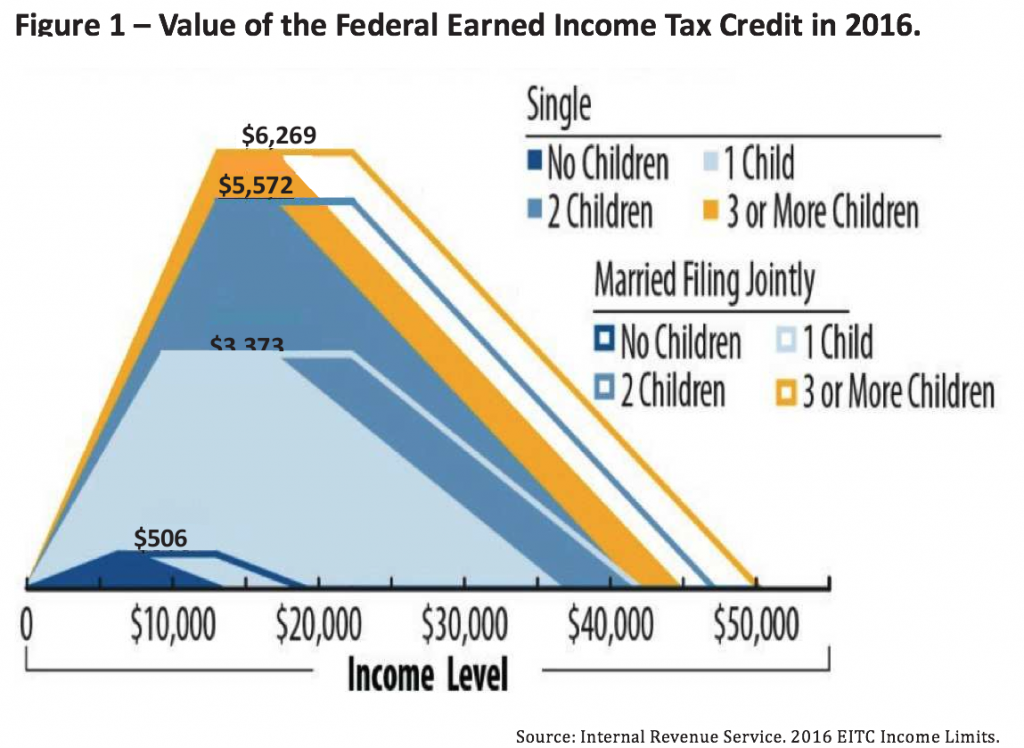

The Amount Of The Eitc Depends On The Amount You Earned From Working For Someone Or For Yourself, Whether You Are Married Or Single, And The Number Of.

Images References :

Source: techplanet.today

Source: techplanet.today

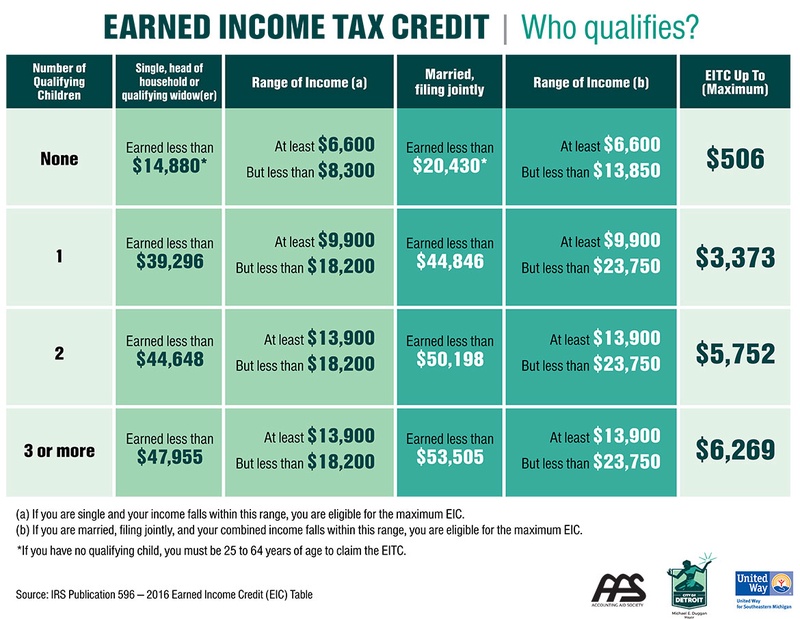

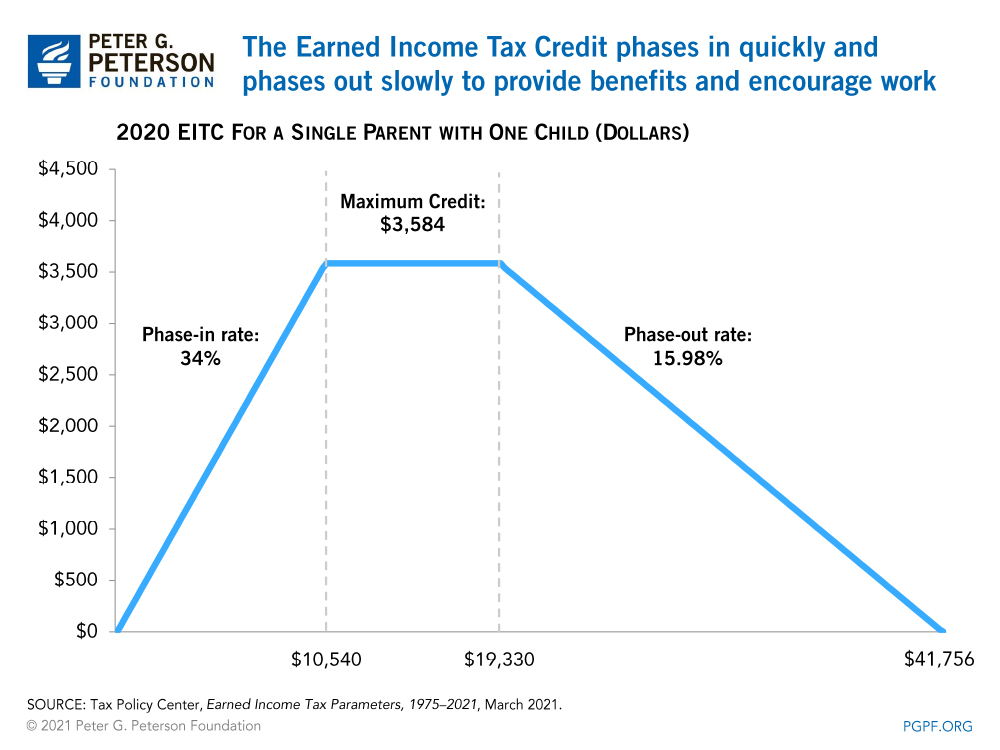

The Ultimate Guide to Help You Calculate the Earned Credit EIC, 2024 earned income tax credit (for taxes filed in 2025) how do you qualify for the earned income tax credit? If you earned less than $63,398 (if married filing jointly) or $56,838 (if filing as an individual, surviving spouse or head of household) in tax year 2023, you may.

Source: www.templateroller.com

Source: www.templateroller.com

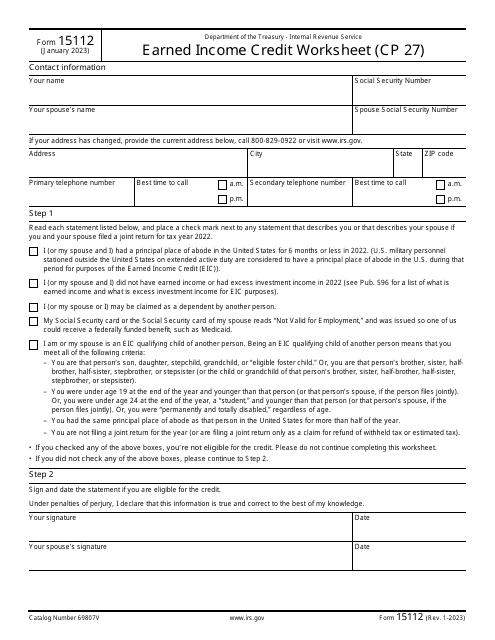

IRS Form 15112 Download Fillable PDF or Fill Online Earned, Apr 26, 2024 11:52 am ist. Married person or civil partner:

Source: fabalabse.com

Source: fabalabse.com

How much is the EITC for a single person? Leia aqui How much earned, The niit’s 3.8 per cent surtax is applied in addition to standard income taxes if a person’s total income exceeds a certain threshold: The dollar am out of credits ranges from $600.

Source: www.pgpf.org

Source: www.pgpf.org

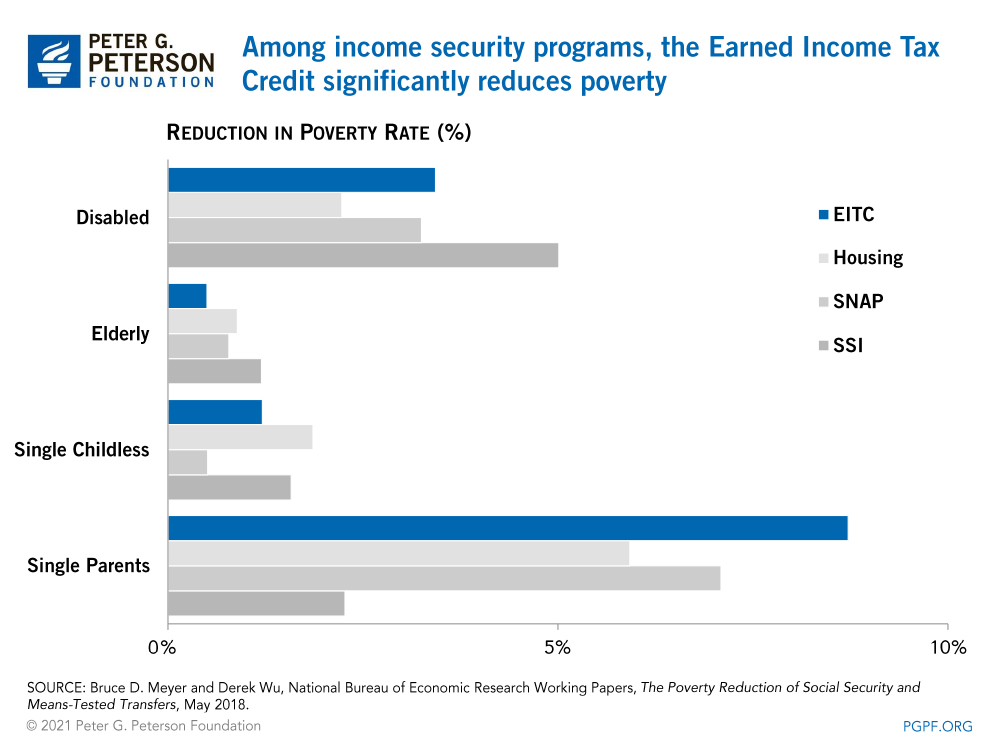

What Is the Earned Tax Credit?, Married person or civil partner: If you make $70,000 a year living in wisconsin you will be taxed $10,401.

Source: fabalabse.com

Source: fabalabse.com

Can a single person get the earned credit? Leia aqui What is, Married person or civil partner: Eitc income limits 2024 single person.

Source: taxfoundation.org

Source: taxfoundation.org

Earned Tax Credit? (EITC) Definition TaxEDU, How much is the eitc? The delay could be an automated message for taxpayers claiming the child tax credit or earned income tax credit sent because of additional fraud protection steps.

Source: pluseli.com

Source: pluseli.com

The Best To Live A Great Life PLUSELI, If you earned less than $63,398 (if married filing jointly) or $56,838 (if filing as an individual, surviving spouse or head of household) in tax year 2023, you may. Must have lived in the united states for more than half of the tax year, either you (or your spouse if filing a joint return) must be at least age 25 but less than age 65.

Source: study.com

Source: study.com

Earned Tax Credit Overview & Examples Lesson, Eitc income limits 2024 single person. For 2023, the income restriction is $17,640 for single people and $24,210 for married filing together once no eligible children are involved.

Source: dolliqjuieta.pages.dev

Source: dolliqjuieta.pages.dev

Tax Brackets 2024 Irs Single Elana Harmony, The tax year 2024 maximum earned income tax credit amount is $7,830 for qualifying taxpayers who have three or more qualifying children, an increase of from. If you make $70,000 a year living in wisconsin you will be taxed $10,401.

Source: fabalabse.com

Source: fabalabse.com

Can a single person get the earned credit? Leia aqui What is, There are numerous qualification rules. People should understand which credits and deductions they.

2024 Earned Income Credit Table (Maximum Credit Amounts &Amp; Income Limits) More References.

Us$200,000 for single or head of.

The Maximum Agi For Single Filers Or Heads Of Household Is $52,838.

2024 earned income tax credit (for taxes filed in 2025) how do you qualify for the earned income tax credit?