Canada Tax Brackets 2024. 14 rows for 2024, the marginal rate for $173,205 to $246,752 is 29.32% because of the. Here are the tax brackets for canada based on your.

2023 federal income tax brackets. What if your pay period is not in this guide?

Below Are The Important Dates For The Canada Tax Return In 2024:

For 2024, the irs made adjustments to federal income tax brackets to account for inflation, including raising the standard deduction to $14,600 (up from $13,850) for single filers.

Here Are The Tax Brackets For Canada Based On Your.

All set to file your taxes?

At Income Levels Above $173,205, The.

Federal tax brackets for 2024.

Images References :

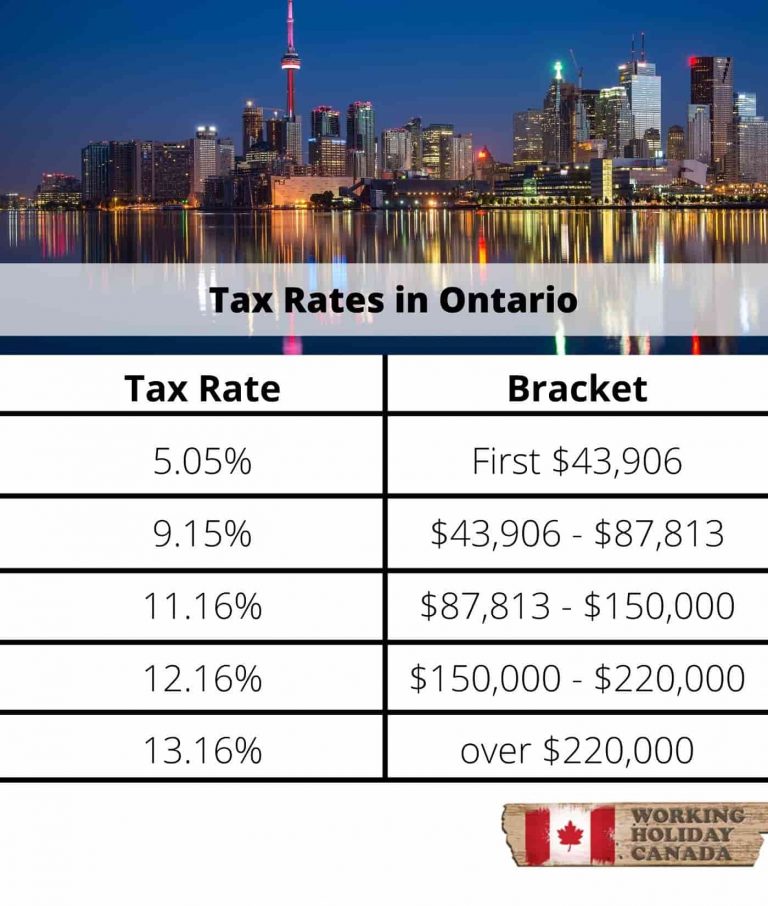

Source: workingholidayincanada.com

Source: workingholidayincanada.com

The basics of tax in Canada », Below are the important dates for the canada tax return in 2024: 61 rows the following are the provincial/territorial tax rates for 2023 (in addition to federal tax) according to the cra:

Source: maplemoney.com

Source: maplemoney.com

2024 Canadian Tax Brackets What You Need to Know, That means you'll be on the hook for less federal tax next year and will have less money. Last week, president biden’s 2024 state of the union address presented a vision of higher taxes for american businesses and high earners combined with.

-1625833913635.png) Source: canadianvisa.org

Source: canadianvisa.org

Canadian Tax Rates, The government of canada has introduced new reporting requirements for trusts. 2024 federal budget — on the trail of possible tax changes.

Source: www.pelajaran.guru

Source: www.pelajaran.guru

Personal Tax Rates 2022 Canada PELAJARAN, Calculate your combined federal and provincial tax bill in each province and territory. The basic personal amount before any personal tax applies has been.

Source: retirehappy.ca

Source: retirehappy.ca

Canada tax brackets Marginal tax vs average tax, Canada's deputy prime minister and finance minister chrystia freeland will deliver canada’s 2024 federal. Here are some new numbers and key dates to consider for 2024, starting with tax brackets on employment income:

Source: coinledger.io

Source: coinledger.io

Crypto Tax Rates Canada 2024 Breakdown CoinLedger, Last week, president biden’s 2024 state of the union address presented a vision of higher taxes for american businesses and high earners combined with. In 2024, the first $55,867 would be taxed at 15 per cent ($8,380.05) while the remaining portion would be taxed at 20.5 per cent ($847.26).

Source: www.headllinetoday.com

Source: www.headllinetoday.com

Canada Vs Usa Tax Brackets A Comparison In 2023, The basic personal amount before any personal tax applies has been. Here are some new numbers and key dates to consider for 2024, starting with tax brackets on employment income:

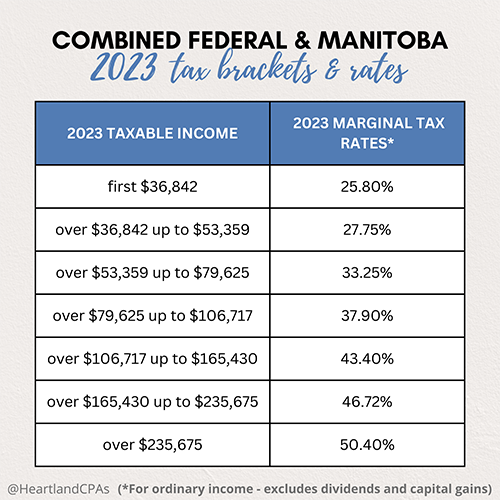

Source: www.heartlandcpa.com

Source: www.heartlandcpa.com

Canadian Tax Brackets, Calculate your combined federal and provincial tax bill in each province and territory. In total, that adds up to.

![The Basics Of Tax In Canada [Updated For 2022]](https://workingholidayincanada.com/wp-content/uploads/2022/04/Canada-Federal-Tax-Rates-2022.png) Source: workingholidayincanada.com

Source: workingholidayincanada.com

The Basics Of Tax In Canada [Updated For 2022], Federal and provincial/territorial income tax rates and brackets for 2024. Affected trusts will be required to file an annual t3 trust income tax and.

Source: workingholidayincanada.com

Source: workingholidayincanada.com

Tax Information Every US Citizen Working In Canada Must Know, For 2024, the irs made adjustments to federal income tax brackets to account for inflation, including raising the standard deduction to $14,600 (up from $13,850) for single filers. 61 rows the following are the provincial/territorial tax rates for 2023 (in addition to federal tax) according to the cra:

Deadline To Contribute To An Rrsp, A Prpp, Or An Spp.

At income levels above $173,205, the.

The Calculator Reflects Known Rates As Of January.

Ontario indexes its tax brackets and surtax thresholds using the same formula as that used federally, but uses the provincial inflation rate rather than the federal rate in the.

2024 Personal Tax Calculator | Ey Canada.

Current as of december 31, 2023.